how to value a stock

The most common way to value a stock is to compute the companys price-to-earnings PE ratioThe PE ratio equals the companys. Ad ETF seeks to pay a distribution rate of 7 the funds net asset value come rain or shine.

How To Value A Stock A Trader S Guide To Stock Valuation

Ad Beginner Step-By-Step Guide.

. Find The Perfect Brokerage For You. Many analysts point out to a general froth in valuations and the potential for multiples to compress eventually. Learn More About Account Fees Minimums And Promotions.

Learn The Basics Of How To Buy Stocks. What is Stock Valuation. Ad ETF seeks to pay a distribution rate of 7 the funds net asset value come rain or shine.

Ad Get in now before this little-known penny stock takes off. Every investor who wants to beat the market must master the skill of stock valuation. Click to Watch Now.

It is a popular and. Essentially stock valuation is a method of determining the intrinsic value. High-growth companies have performed very well in the past decade.

The cornerstone stock valuation metric is the PE ratio. The Gordon Growth Model GGM is widely used to determine the intrinsic value of a stock based on a future series of dividends that grow at a constant rate.

How To Value A Stock A Trader S Guide To Stock Valuation

/using-price-to-earnings-356427-FINAL2-b2131aeaca004b6aa094e5fd986becab.png)

Using The P E Ratio To Value A Stock

How To Value A Stock A Trader S Guide To Stock Valuation

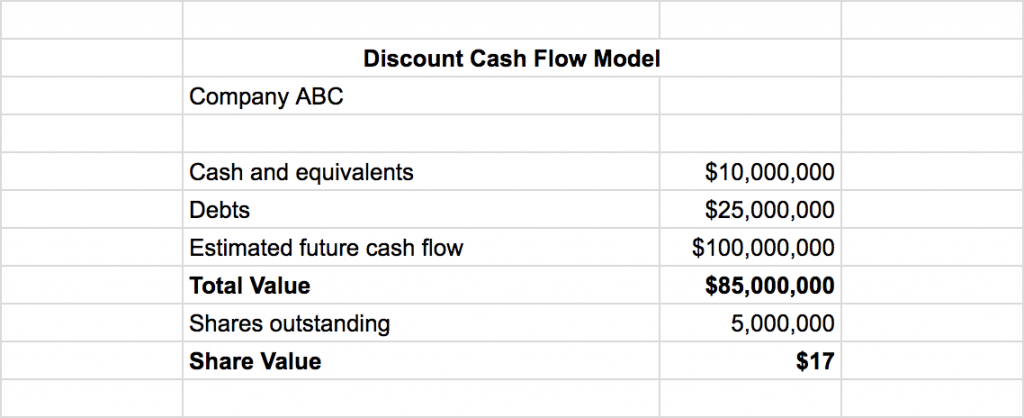

How To Value A Stock Like Warren Buffet The Discount Cash Flow Valuation The Long Run Plan

How To Value A Stock Double Entry Bookkeeping

How To Value A Stock A Trader S Guide To Stock Valuation

0 Response to "how to value a stock"

Post a Comment